ESG in Cross-border M&A

Sustainability is becoming an increasingly important factor for the analysis of both private and public companies, and a company’s sustainability profile can have a direct impact on its valuation, growth prospects, public perception, access to capital, employee retention, as well as its governmental and public relations.

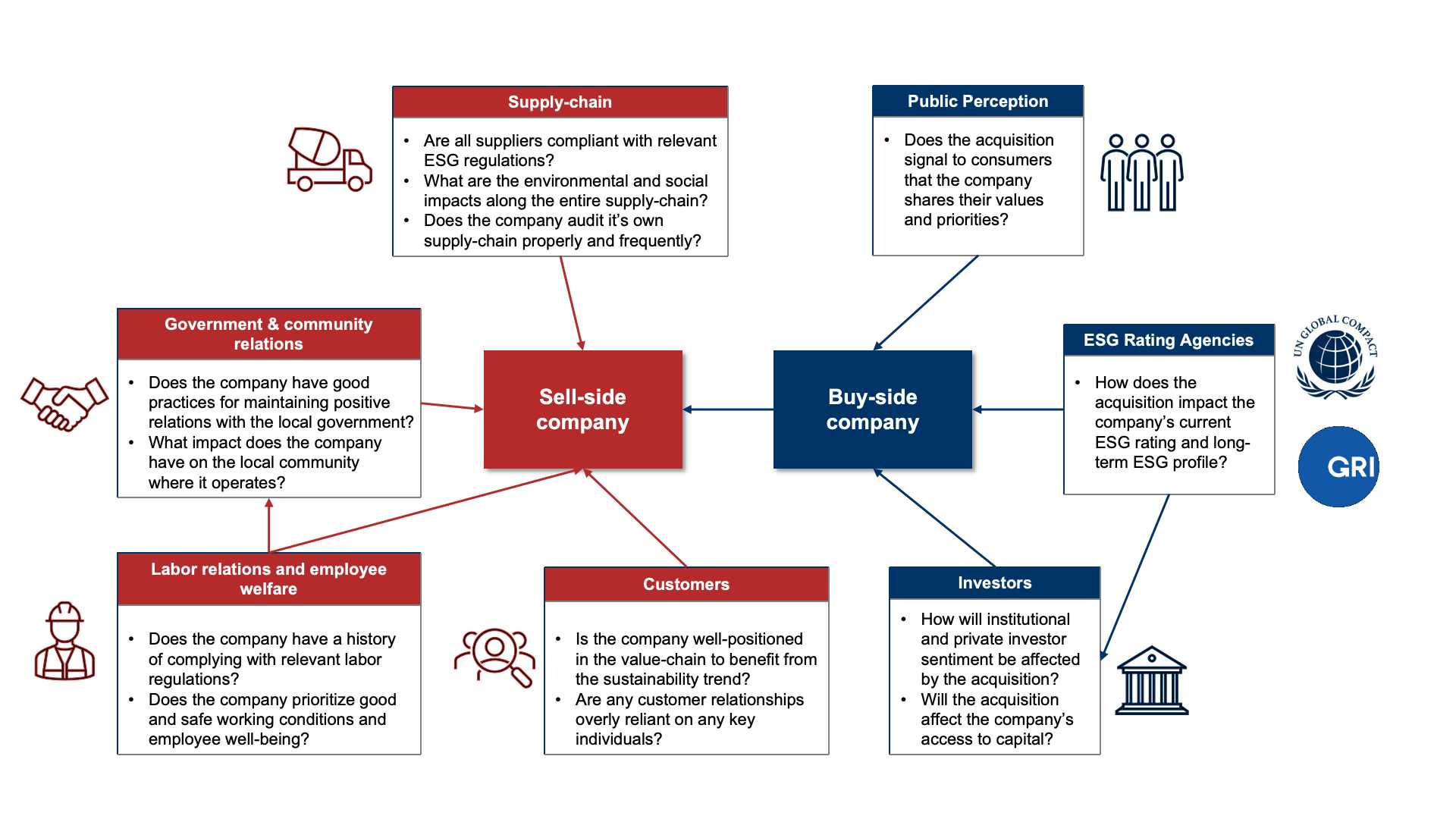

For this reason, companies looking to advance their inorganic growth via M&A need to include a thorough audit and analysis of the sustainability propositions of potential target companies, as well as ensuring that the acquisition is in line with their long-term sustainability-related objectives.

The sustainability concept is usually condensed into the framework of ESG and its three constituent categories. The three letters that make up the ESG concept cover different aspects of a company’s sustainability profile and are presented below, together with some of the most relevant factors for each category:

- Environmental – Climate change impact, resource usage, waste management, pollution, and regulatory compliance.

- Social – Labor practices, security and privacy, community relations, health and safety, and human rights.

- Governance – Board structure, risk management, executive compensation, shareholder rights, and compliance with laws and regulations.

Using both standardized and bespoke measurements derived from these three categories, internal and external stakeholders can estimate the sustainability proposition of a given company, which in turn ultimately affects the value and attractiveness of the business.

ESG’s impact on company valuation

ESG considerations are increasingly being a part of company valuation for both private and public companies. The ESG due diligence process can uncover risks that may lead to regulatory fines, reputational damage, or operational inefficiencies, potentially lowering the target company’s valuation. Conversely, strong ESG performance can enhance valuation by demonstrating sustainability, ethical practices, and a forward-looking management approach.

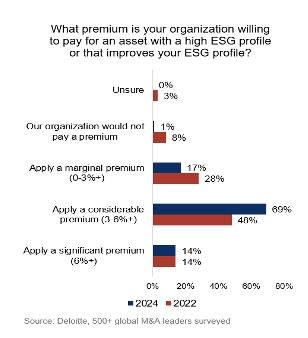

A strong sustainability profile is generally an indication that a company is aligned with market trends, has a strong governance structure, has a lower risk profile, and is generally a more attractive target for investing by virtue of its ESG rating. The diagram below reflects this development:

This observed ESG premium can partially be explained by study findings that show that better ESG performance correlates with higher annual returns of up to 3.8% annually, which leads to a compounded effect of 20% to 45% over 5 to 10 years. Correctly assessing the ESG level of a target company is closely linked to the appropriate valuation of the company.

Identifying material ESG issues during the due diligence process can also influence the valuation to the benefit of the buy-side party of the transaction. The two sides may allow the deal to be completed, following a renegotiation to more beneficial and legally viable terms for the buyer. A renegotiation of terms can lead to measures such as adjusting the purchase price, changing the deal structure, or deciding on certain indemnities.

ESG Due Diligence (DD) in cross-border M&A

Any M&A process involves multiple DD processes all happening in parallel, in order to ensure that the relevant stakeholders have a full understanding of the health and condition of the company in a broad range of categories from financial, commercial, legal, ESG, etc. It is during this process that the acquiring company can get a deeper and fuller understanding of the company which it is considering acquiring.

For companies doing cross-border M&A, a proper ESG DD process can be of even greater importance than usual due to a possible lack of insight into local business practices and value-chains.

Trends and Challenges in ESG for Nordic Companies in Cross-Border M&A

- Sustainability-Driven M&A Strategy

The Nordic countries of Sweden, Denmark, Finland, and Norway, have long been recognized for their sustainable development policies and environmental focus. Many Nordic companies set high standards in environmental protection and social responsibility. In cross-border M&A, Nordic companies tend to prioritize choosing those target companies that align with their sustainability goals. This approach not only protects the post-merger corporate image, but also supports the growth of green technologies and renewable energy businesses.

- Environmental Impact Assessment

For Nordic companies, environmental factors in ESG due diligence are critical. In cross-border M&A, companies assess the environmental impact of the target company, such as carbon emissions, waste management, and energy usage. For targets with high carbon emissions or non-compliance with environmental regulations, Nordic buyers may re-evaluate the deal’s value, structure or request the target company to address these issues. On the other hand, strong environmental performance can enhance the valuation by demonstrating a commitment to sustainability and an alignment with positive trends.

- Social Responsibility and Labor Conditions

Social responsibility is another critical factor. In cross-border M&A, Nordic buyers particularly focus on the target’s practices related to labor conditions, employee welfare, consumer protection, and community relations. If the target company has labor-related issues or does not comply with social responsibility standards, it could negatively affect the deal decision or lead to a renegotiation of terms.

Conclusion

By prioritizing ESG in M&A, companies can not only mitigate risks but also enhance their strategic value, showing their commitment to sustainability and responsible business practices. This is especially relevant for Sino-Nordic M&A, where both regions have unique sustainability standards that need to be aligned during the integration process. For companies aiming for long-term growth, integrating ESG factors into M&A decisions is not just a regulatory requirement but a strategic advantage.

For further insights on ESG strategies in Sino-Nordic cross-border M&A, Nordic Match offers expert advisory services to help businesses navigate through complexities by integrating sustainability practices into their M&A decisions.

About Nordic Match

Nordic Match is a boutique M&A and Strategy Advisor headquartered in Shanghai, China. Dedicated to Sino-Nordic transactions, we have a clear vision – to support aspiring corporates and investors in search for value-creating opportunities between Nordics and China.

More about Nordic Match: www.nordic-match.com